Finding and Obtaining Your Social Security Number in Germany

In Germany everybody who is working needs a Social Security number but…

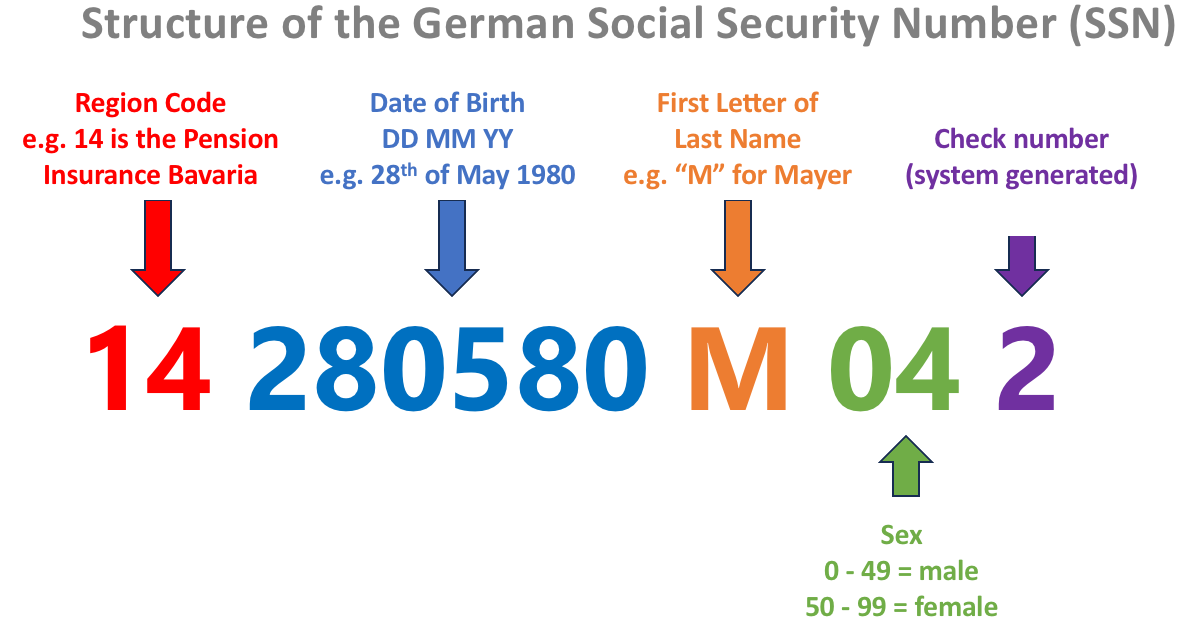

Where to find the German Social Security Number (SSN)?: You can find the number on your monthly German salary statement (Lohn-Gehalt Verdienstabrechnung) you have received from your employer. The number is mentioned as: SV-Nr or SVNR Number – Sozialversicherungsnummer - Social Insurance number or RV-Nr or RNVR Number – Rentenversicherungsnummer or Versicherungs-Nr. - PI Number - Pension Insurance Number. Number is easy to identify as it includes your birth date: example: = 28.05.1980 (DD/MM/YY) -> 280580. It also includes the first letter of your last name. example: = Mayer -> "M". It has 12 digits. example: 14 280580 M 042

Making Sense of Your German Social Security Number

Your German social insurance number is a unique 12-digit identifier that remains with you for life. It is structured in a particular format: the first two digits signify the day of your birth; the following two for the month; next, come two digits for your birth year; ensuing that are three digits for the code of your birthplace; the next two are an identifying number, and the final digit is a control number. This number is of importance as all your social security contributions are recorded under this number.

How to obtain your Social Security Number in Germany?

Everybody who wants to work in Germany needs a Social Security number (SSN). If you just arrived in Germany and are about to start working as an Expat, ask your employer if they take care of the application for your Social security number. Typically, your employer initiates the process of obtaining a German SSN and communicates it to you. However, if you're self-employed, and you'll have to apply for it yourself. Both scenarios require the same five documents: a valid passport, registration certificate (Anmeldung), health insurance certificate, employment contract, and if applicable, your residence permit.

The process of obtaining the German social insurance number, or Sozialversicherungsnummer, may initially seem complex, but basically is quite straightforward.

You need following documentation:

- Valid passport for identification

- Work contract

- Residence permit

- Residential registration “Anmeldung” at the city where you live

- health insurance certificate

Now that you have your documents ready, the actual application process begins. You need to contact the German pension office which is responsible for you. In Germany there are 16 different entities of the Public Pension Insurance “Rentenversicherung”. As an example: Just because you live and work in Düsseldorf and you work at Henkel, does not automatically mean that you will be registered at the DRV Rheinland / Pension Insurance Rhineland but you could also be managed e.g. by the DRV Knappschaft-Bahn-See.

If you are self employed and have no clue about who is responsible, easiest is to send an email to meinefrage@drv-bund.de and ask them. Make sure you always mention your current address as the pension insurance might not answer via Email due to data protection.

Here a list of the 17 German Pension Insurance entities:

- DRV Baden-Württemberg

- DRV Bayern-Süd

- DRV Berlin-Brandenburg

- Deutsche Rentenversicherung Braunschweig-Hannover

- DRV Bund

- DRV Hessen

- DRV Knappschaft-Bahn-See

- DRV Mitteldeutschland

- DRV Nord

- DRV Nordbayern

- DRV Oldenburg-Bremen

- DRV Rheinland

- DRV Rheinland-Pfalz

- DRV Saarland

- DRV Schwaben

- DRV Westfalen

Under following link you find the contact details of each entity: https://www.deutsche-rentenversicherung.de/DRV/DE/Beratung-und-Kontakt/Kontakt/Anschriften-Uebersicht/anschriften-uebersicht_node.html?https=1

Why is the German Social Security Number important?

As an expat arriving in Germany, getting your German Social Security Number (SSN) is important because for work, legal and financial purposes. It is important to know that the SSN number is not the same as your tax identification number. The benefits of a German Social Security Number go beyond basic identification - it links you directly to the comprehensive German social security system. This means access to health, unemployment, pension, and long-term care insurance – essential factors in supporting your life and career in Germany.

How to get a refund of your German Pension contributions?

First check if you are eligible to get a refund. You can use our free eligibility check

We are experts on the refund process.

Now it’s your turn:

The eligibility check is free of charge and takes less then 1 minute.

We will show you the result instantly.